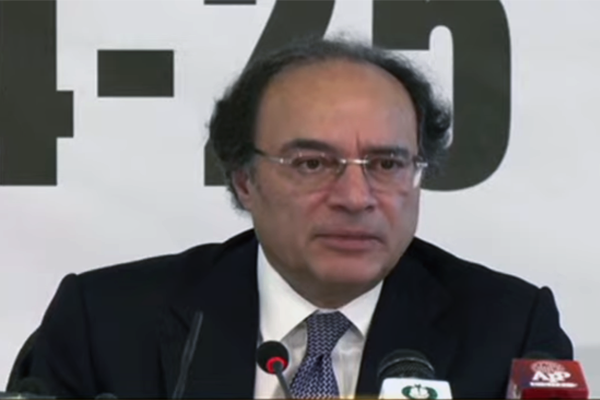

Finance Minister Muhammad Aurangzeb has said that while Pakistan is showing early signs of macroeconomic recovery, achieving sustainable economic growth will require bold and often difficult structural reforms.

He made these remarks on Monday during a high-level dialogue organized by the Overseas Investors Chamber of Commerce and Industry (OICCI), which brought together key representatives from over 200 leading multinational companies operating in Pakistan.

The session provided a platform for the finance minister to present the government’s economic recovery outlook, address investor concerns, and outline future policy directions aimed at attracting foreign direct investment (FDI) and ensuring macroeconomic stability.

Aurangzeb expressed cautious optimism, noting that the country is beginning to see improved macroeconomic indicators and a resurgence in business confidence. These encouraging signs, he said, are reflected in the latest OICCI Business Confidence Survey, which shows rising optimism among foreign investors.

He attributed this progress to a combination of the government’s strategic reforms, improved policy implementation, and the resilience of key economic sectors, including agriculture, IT, and manufacturing.

“We are witnessing early signs of macroeconomic recovery, but to break free from the recurring cycles of instability, Pakistan must take bold and sometimes difficult decisions,” Aurangzeb stated.

The finance minister emphasized that the path to long-term economic stability lies in structural reforms and policy consistency. He pointed out that Pakistan’s economy has suffered from repeated cycles of instability due to short-term decision-making and policy reversals.

To address these issues, Aurangzeb stressed the importance of creating a transparent, predictable, and investor-friendly environment. He assured the foreign business community of the government’s resolve to maintain macroeconomic discipline and implement reform-oriented policies.

Responding to the concerns raised by OICCI members, Aurangzeb reaffirmed the government’s commitment to supporting businesses by removing regulatory hurdles, ensuring transparent governance, and fostering a stable policy framework.

He also encouraged foreign investors to explore high-potential sectors such as:

- Mining and Minerals

- Agriculture

- Information Technology

- Infrastructure Development

These sectors, he said, have the potential to become growth engines for the national economy.

As part of the government’s inclusive growth strategy, the finance minister announced that efforts are underway to increase financing for Small and Medium Enterprises (SMEs). This initiative aims to raise SME financing to 17% of private sector credit by 2028, thereby supporting entrepreneurship and employment generation.

He added that the government has also urged banks to collaborate with investors to revive sick industrial units, which could significantly contribute to industrial output and reduce economic stagnation in struggling regions.

Aurangzeb noted that the government is actively working on reducing its own expenditures to ease the fiscal burden and direct resources toward more productive uses. He also highlighted the importance of strengthening economic institutions for sustainable development.

“Economic reforms are absolutely critical,” the minister noted. “But we must also address existential issues like governance inefficiencies, over-regulation, and institutional fragility.”

OICCI President Yousaf Hussain welcomed the signs of economic stability and praised the government’s efforts. However, he emphasized the need to strengthen institutions, invest in human capital, and maintain policy consistency to ensure that the current momentum translates into sustained growth.

“We welcome the improving macroeconomic indicators and renewed signs of stability,” said Hussain. “But to convert this into long-term gains, we must invest in professional capacity and institutional reform.”

OICCI Secretary General Abdul Aleem also addressed the forum, highlighting the low level of foreign direct investment in Pakistan, which currently stands at less than 1% of GDP. While he praised the government’s focus on simplifying regulations, he pointed out that the exit of several multinational companies indicates the urgent need to improve the investment climate and reduce over-regulation.

The finance minister concluded the session by expressing gratitude to OICCI for organizing a meaningful dialogue focused on economic reform and investment promotion. He emphasized that rebuilding investor confidence remains a top priority for the government.

“Pakistan’s full investment potential can only be unlocked through serious, sustained reforms and collaboration between government and business,” he said.

With macroeconomic recovery gradually taking shape, Pakistan is at a pivotal moment. The government’s focus on structural reforms, investment in high-potential sectors, and SME financing sends a strong signal to both domestic and foreign investors.

However, experts agree that to sustain this recovery, Pakistan must stay the course on difficult but necessary decisions, eliminate policy inconsistency, and strengthen its institutions.

If successful, these efforts could place the country on a path to long-term economic stability, benefiting both the public and private sectors.