PTBP Web Desk

The Federal Board of Revenue (FBR) has imposed a cash transaction limit of Rs200,000. This limit applies not only to retail outlets in physical markets but also to e-commerce platforms offering Cash on Delivery (COD) services.

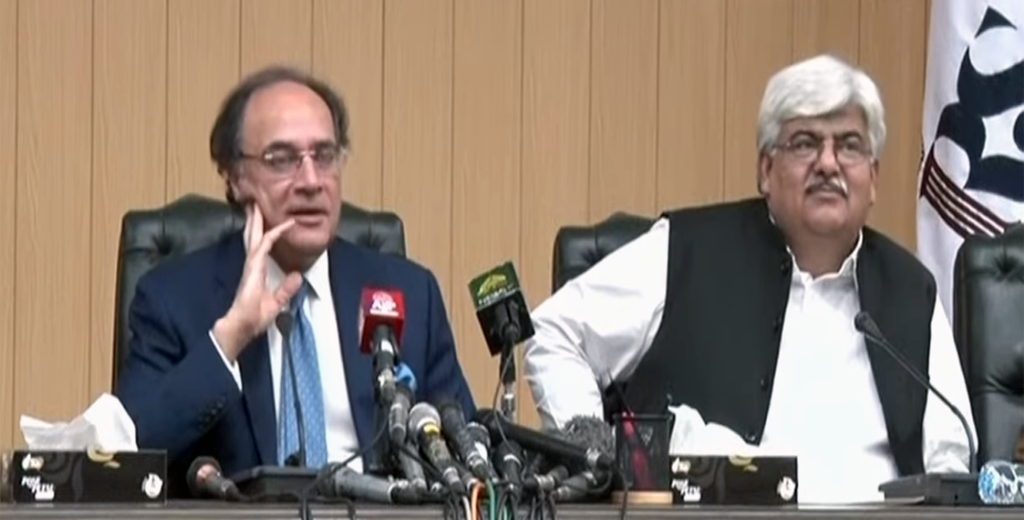

The decision, announced through Circular No. 02 of 2025-26 (Income Tax) issued on Friday, reinforces the government’s broader agenda of developing a cashless economy and reducing reliance on paper-based currency.

According to the circular, all cash-based payments exceeding Rs200,000 will not be accepted under section 21(s) of the Income Tax Ordinance 2001. The FBR clarified that the same principle applied to retail transactions will also apply to online orders delivered under the Cash on Delivery (COD) model.

This means consumers purchasing goods from e-commerce platforms must ensure their cash payments remain within the prescribed limit. Similarly, traditional retail buyers are also required to follow this regulation when making large purchases in cash.

The Rs200,000 limit is applicable per transaction, and exceeding it may result in tax complications, penalties, or non-recognition of the expenditure for tax purposes.

The circular highlighted that this measure is part of the government’s long-term vision to promote a cashless economy. By capping cash transactions, policymakers hope to:

- Reduce the size of the informal economy.

- Encourage the use of banking channels for large transactions.

- Increase documentation of economic activity.

- Improve tax compliance.

In recent years, Pakistan has struggled with the size of its undocumented economy, which weakens tax revenue collection. By limiting large-scale cash usage, the government aims to encourage businesses and individuals to adopt digital banking, online payments, and card transactions.

For instance, platforms like Raast, Pakistan’s instant payment system developed by the State Bank of Pakistan (SBP), are designed to facilitate low-cost digital payments. Such initiatives complement the government’s policy of reducing dependency on cash.

External Link: Read more about Raast, Pakistan’s digital payment system

For retail markets across Pakistan, the Rs200,000 transaction cap is likely to create a shift in how customers pay for high-value goods. Retailers selling electronics, home appliances, or jewelry often handle large cash transactions. With the new rule, customers will now be encouraged to pay through:

- Bank transfers

- Debit/credit cards

- Mobile wallets

- Online payment gateways

While this may initially inconvenience cash-preferred buyers, industry experts believe the change will ultimately enhance transparency and accountability in retail operations.

The extension of the cash transaction limit to e-commerce COD orders is particularly significant. In Pakistan, Cash on Delivery remains the most popular payment method, accounting for more than 80% of online purchases.

E-commerce companies will now need to adopt stricter systems to ensure no COD order exceeds Rs200,000 in value. This could encourage greater adoption of:

- Digital wallets

- Mobile banking apps

- Prepaid debit/credit card transactions

By pushing consumers toward online payments, the government expects to reduce operational inefficiencies linked with COD and enhance the growth of Pakistan’s fintech sector.

Internal Link: See our detailed report on Pakistan’s e-commerce growth

Tax experts have welcomed the move, calling it a necessary step toward financial documentation. They argue that such measures will not only help the FBR track large transactions but also reduce opportunities for money laundering and tax evasion.

However, challenges remain. Pakistan’s low rate of financial inclusion means millions of consumers still lack access to banking facilities. According to the World Bank, only around 21% of Pakistanis have bank accounts. Without adequate infrastructure and awareness, some argue that the new cash cap may cause short-term disruptions, especially in rural markets where digital adoption remains slow.

The FBR has clarified that businesses must update their point-of-sale systems and accounting procedures to comply with the Rs200,000 cap. Retailers and e-commerce platforms found violating the rule could face penalties or disallowance of expenses when filing taxes.

Authorities also plan to increase digital audits and monitoring of cash transactions to ensure strict compliance. To ease the transition, the FBR is encouraging businesses to integrate digital payment gateways and work with banks to provide user-friendly solutions to customers.

The FBR’s decision marks a bold step toward curbing Pakistan’s reliance on cash. While the transition may present hurdles, especially for traditional markets and COD-heavy online platforms, it also opens the door for innovation in digital payments.

If implemented effectively, the Rs200,000 cash transaction limit could reshape Pakistan’s retail and e-commerce landscape, reduce the shadow economy, and contribute to stronger tax revenue collection.