PTBP Web Desk

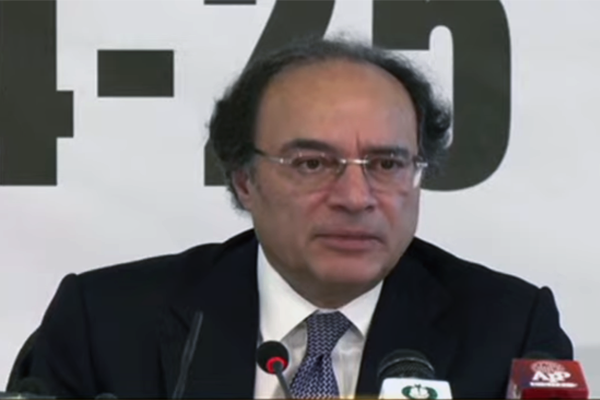

The Federal Board of Revenue (FBR) Chairman, Rashid Mahmood Langrial, has provided an in-depth explanation regarding the significant revenue shortfall experienced during the first half of the fiscal year 2024-25. According to Langrial, the FBR has encountered a deficit of Rs384 billion, primarily due to a slowdown in the autonomous growth of revenue collection which was initially anticipated at the time of the budget setting.

Exchange Rate Stability: The stability in exchange rates has not led to the expected increase in revenue, as fluctuations often result in higher tax collections through customs duties and other trade-related taxes.

Lower Inflation: Inflation rates were lower than what was forecasted, which means less revenue was generated from taxes linked to consumer spending and price increases.

Slow Manufacturing Recovery: The large-scale manufacturing sector did not bounce back as hoped from previous economic downturns, thus not contributing as expected to the tax revenue.

Subpar GDP Growth: The GDP growth was less than projected, directly impacting the overall tax collection since a growing economy typically leads to higher tax yields.

Langrial mentioned that this trend is expected to persist through January and February 2025, with the total projected loss in autonomous growth reaching Rs447 billion by February. However, he remains optimistic, stating that a recovery in revenue collection is anticipated in the last four months of the fiscal year, potentially avoiding further losses due to autonomous growth in those months.

The Finance Act 2024 introduced policy measures aiming for a revenue increase of Rs1.3 trillion. However, these measures have not performed as expected, with a shortfall of Rs251 billion in the first six months. This shortfall could escalate to Rs539 billion if no corrective actions are implemented, largely due to behavioral adjustments in sectors like real estate and trading, as well as estimation errors in policy impact.

Despite these setbacks, there are some positive developments. The number of registered retailers has significantly increased from 0.2 million to 0.6 million, broadening the tax base. Additionally, the tax paid through income tax returns has seen an uptick, reaching Rs105 billion this year, suggesting some success in expanding tax compliance.

The FBR has collected Rs5,624 billion in taxes against a target of Rs6,008 billion, leading to a shortfall of Rs384 billion. The tax-to-GDP ratio has improved from 9.5% in the first quarter to 10.8% in the second, although it remains below the IMF’s target of 13.6% for the end of the program period. Comparatively, India’s tax-to-GDP ratio stands at a much higher 18%.

Langrial emphasized that the FBR is committed to adjusting strategies to mitigate this shortfall, focusing on both broadening the tax base and improving the efficiency of tax collection. This commitment was communicated during a briefing to the Senate Standing Committee on Finance, where the chairman also defended the FBR’s efforts by pointing to the increase in the tax-to-GDP ratio as a sign of progress.

The FBR’s approach now includes revisiting policy measures, enhancing enforcement, and possibly recalibrating expectations for the remainder of the fiscal year to align with the current economic realities.