PTBP Web Desk

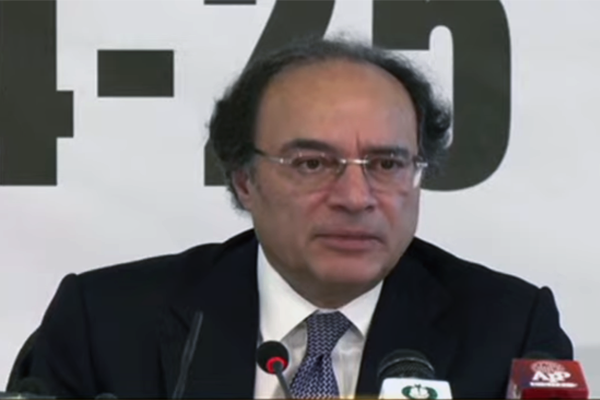

Finance Minister and Revenue Minister, Muhammad Aurangzeb, expressed optimism about the nation’s economic trajectory, emphasizing sustainable growth through Shariah-compliant financing mechanisms like Sukuk bonds. Speaking virtually at the Second International Islamic Capital Markets Conference & Expo in Karachi, the minister outlined the critical role Islamic finance can play in addressing the country’s development needs.

Aurangzeb acknowledged the economic challenges Pakistan faced in recent years but maintained that necessary corrective measures had been implemented. He stated, “We are now on the right trajectory toward macroeconomic stability and moving forward to sustainable growth.” The government, he said, remains committed to addressing issues such as infrastructure development and poverty alleviation by leveraging innovative Islamic financial instruments.

Highlighting the significance of Sukuk bonds, Aurangzeb noted their potential to mobilize critical financing for infrastructure projects and social development. Islamic finance, he stressed, offers an ethical alternative to conventional interest-based borrowing, aligning financial practices with Shariah principles.

“With the mechanism in place, Pakistan has the potential to emerge as a leading global hub for Islamic finance,” Aurangzeb added, pointing to the growing global demand for ethical investment opportunities.

The Finance Minister underscored Pakistan’s strides in fostering a Shariah-compliant financial ecosystem. He revealed that 56% of market capitalization at the Pakistan Stock Exchange (PSX) comprises Shariah-compliant securities. Furthermore:

- 48% of mutual fund assets under management adhere to Shariah principles.

- 66% of voluntary pension fund assets are Shariah-compliant.

- 95% of assets in Real Estate Investment Trusts (REITs) align with Islamic financial guidelines.

These figures, he said, reflect Pakistan’s commitment to integrating Islamic finance into its broader economic framework.

Aurangzeb reiterated the government’s resolve to reduce reliance on interest-based borrowing, an approach aligned with the broader vision of transforming Pakistan’s financial system. “Pakistan is committed to raising new investments through Islamic products,” he said, emphasizing the importance of fostering investor confidence in Shariah-compliant offerings.

The conference, which brought together experts from across the globe, served as a platform for Pakistan to highlight its dedication to advancing Islamic capital markets. Aurangzeb emphasized the significance of international collaboration in fostering a robust Islamic finance ecosystem, both domestically and internationally.

Deputy Governor of the State Bank of Pakistan, Saleem Ullah, also addressed the conference, shedding light on the challenges of converting Pakistan’s substantial debt portfolio into Shariah-compliant products. While the task is monumental, he acknowledged the progress made and expressed optimism about future efforts.