The Government of Pakistan has clarified that there will be no amendments to the Finance Act 2025 regarding the definition of tax fraud or the procedure for arrest under tax laws. Instead, the Federal Board of Revenue (FBR) will issue an explanatory circular on sales tax laws to address the concerns of the business community.

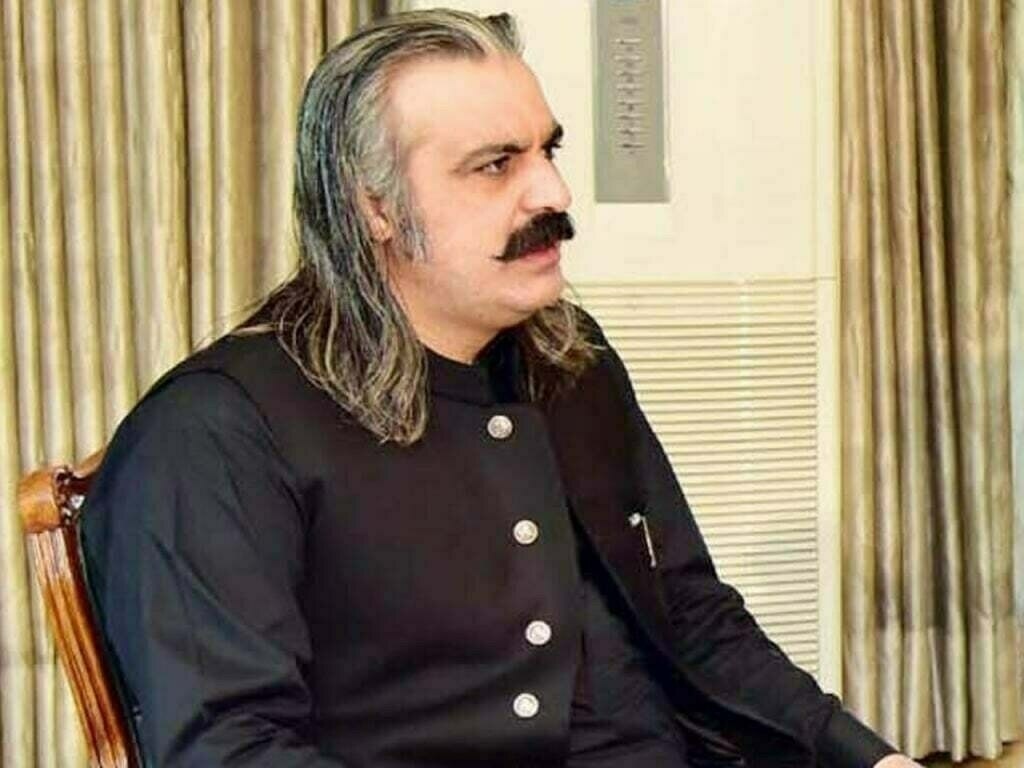

This was announced by Minister of State for Finance, Bilal Azhar Kayani, during a meeting of the Senate Standing Committee on Finance held on Thursday. Kayani emphasized that the Prime Minister has directed the FBR not to harass taxpayers, particularly the business and trade sectors.

“We are fully aware of the concerns raised by business leaders across Pakistan, and I want to make it clear that the Finance Act 2025 will not be revised,” said Kayani. “We are doing our internal homework, and although I cannot disclose specific details due to our engagement with the International Monetary Fund (IMF), I assure the business community that all their concerns will be addressed.”

He added that a major misunderstanding exists around the law concerning the arrest of tax evaders, stressing that this is not a new law. Kayani clarified that safeguards have been added to prevent misuse by tax officers, and that action will only be taken based on substantial evidence.

According to Kayani, the government has already conducted detailed consultations with business chambers and has formed a committee to resolve key issues within 30 days. Presidents of chambers of commerce and industry, including KCCI President Muhammad Jawed Bilwani, have been involved in these discussions.

Bilwani called for the abolition of Clause 9 of Section 37A, which grants the FBR the power to inquire, investigate, and arrest individuals based on suspicion of tax fraud. He argued that arrest on the basis of mere suspicion opens the door to potential misuse and blackmail.

Responding to Bilwani’s concerns, the Senate Committee members highlighted that sufficient safeguards have been implemented to ensure that the arrest powers are not misused. The Finance Act 2025 now requires that a senior-level FBR committee approves any arrest instead of allowing field-level officers such as Additional Commissioners to act independently.

Kayani also announced that monthly meetings will be held with business community representatives to evaluate the law’s practical impact and address any emerging issues.

Dr. Hamid Ateeq Sarwar, FBR Member Inland Revenue (Operations), told the Senate Committee that amending the Finance Act 2025 at this early stage would be inappropriate. “We must avoid creating an impression that Parliament rushed the legislation without proper thought,” he said.

Dr. Sarwar emphasized that the primary goal of the law is to counter fake or flying invoices. The FBR prevented a revenue loss of Rs837 billion during FY 2024–25 due to timely action, and Rs1,373 billion in FY 2023–24.

He further stated that the business community’s concerns have been addressed through a detailed circular, which clarifies that arrests will not be made without concrete evidence. He assured the committee that any tax officer who misuses authority will be held accountable.

“You can visit the FBR’s HRMS section on our official website and view the list of officials who have been penalized for misconduct,” Dr. Sarwar noted, dispelling the notion that corrupt tax officials go unpunished.

Dr. Sarwar also reminded the committee that both the Senate and National Assembly Standing Committees on Finance had reviewed the Finance Bill clause by clause before its approval. While there were time constraints, he acknowledged some stakeholders felt their concerns were not fully incorporated.

However, he stressed that the burden of proving tax fraud now lies with the FBR, not the taxpayer. “This law is not intended to target businesses unfairly. On the contrary, it includes significant improvements to protect legitimate taxpayers,” he said.

While representatives of the business community, including from the Faisalabad Chamber of Commerce and Industry, acknowledged the clarifications provided by the FBR, they raised concerns about blackmail and harassment at field formation levels.

“We are not afraid of the law itself,” said a Faisalabad chamber member. “We are concerned about its misuse on the ground, where tax officers sometimes exploit loopholes for coercion.”

The Chairman of the Finance Committee stated that the government has no intention of victimizing the business community. If the FBR’s upcoming sales tax circular satisfies the concerns of stakeholders, then there would be no need to amend the Finance Act 2025 for the 2025–26 fiscal year.

Letting the law operate with added safeguards and clear accountability mechanisms, as now promised by the FBR, would be a practical way forward, according to the committee.