PTBP Web Desk

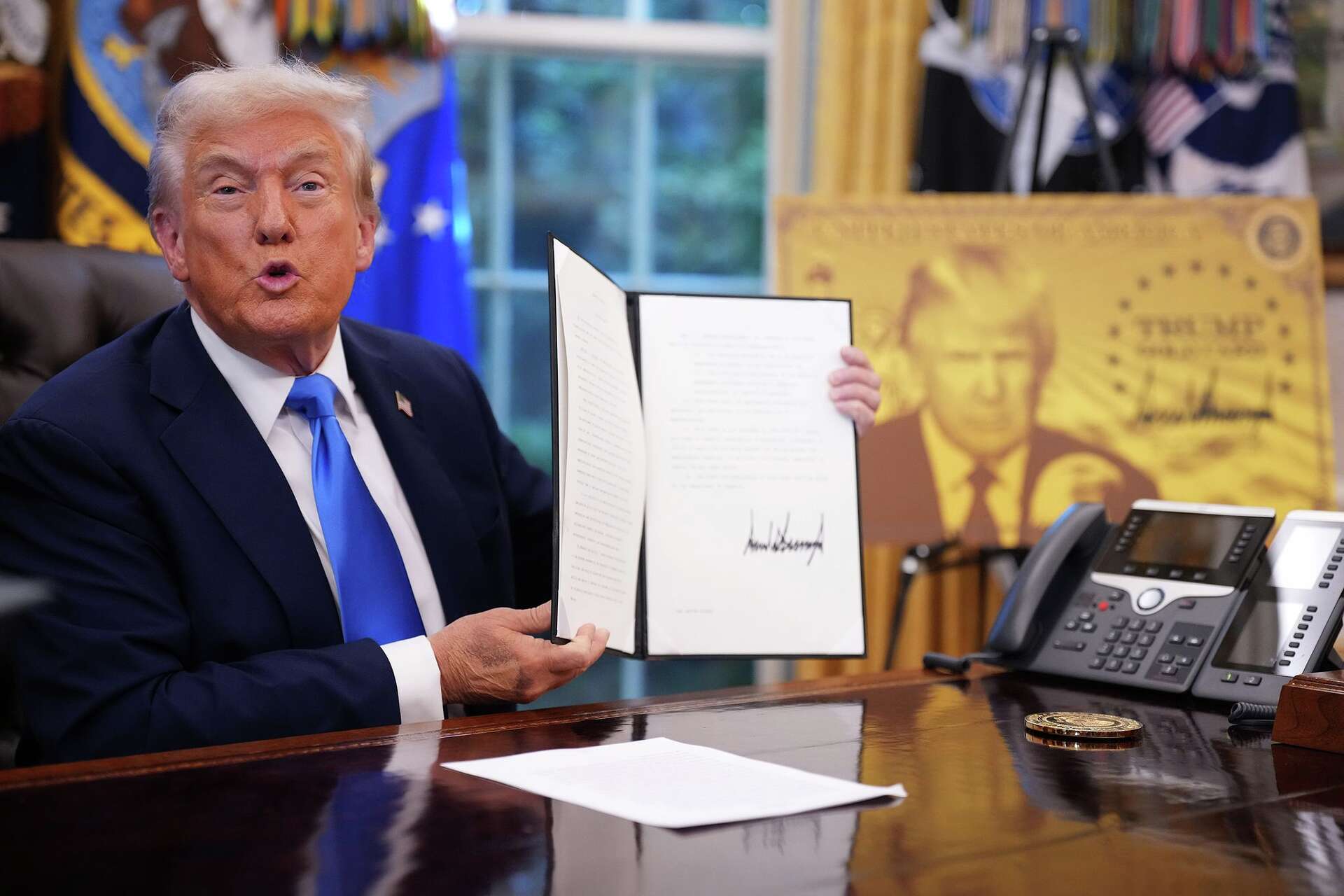

India’s $283 billion information technology sector is bracing for a seismic shift in its operating model following U.S. President Donald Trump’s decision to impose a $100,000 fee on new H-1B visas. The policy, set to take effect from Sunday, is expected to disrupt the decades-old practice of rotating skilled Indian professionals into U.S. projects, a strategy that has fueled the sector’s growth for decades.

The move has triggered alarm across India’s IT industry, which earns nearly 57% of its total revenue from the U.S. market. For years, outsourcing and visa-driven deployments have been central to partnerships with global giants like Apple, JPMorgan Chase, Walmart, Microsoft, Meta, and Alphabet’s Google. However, analysts and tech veterans say that Trump’s order could reshape this model overnight.

According to U.S. government data, India was the single largest beneficiary of the H-1B program last year, accounting for 71% of approved applicants, while China followed with 11.7%. The visa program has historically allowed Indian IT professionals to work onsite in the U.S., managing critical projects and client relationships.

Now, with the steep visa fee, IT companies will be forced to scale down onsite rotations, accelerate offshore delivery centers, and prioritize hiring of U.S. citizens and green card holders.

Ganesh Natarajan, former CEO of Zensar Technologies, noted that the “American Dream” for aspiring IT workers will become far more difficult. He predicted firms would increasingly shift work to offshore hubs in India, Mexico, and the Philippines, limiting cross-border movement.

Major Indian IT firms including Tata Consultancy Services (TCS), Infosys, HCLTech, Wipro, and Tech Mahindra have not yet publicly responded. However, industry body Nasscom warned that the move could have ripple effects on America’s innovation ecosystem while threatening continuity for onshore projects.

Madhavi Arora, Chief Economist at Emkay Global, said:

“Services exports have finally been dragged into the global trade and tech war. This threatens to disrupt the IT sector’s onsite-offshore model, pressuring margins and supply chains.”

Phil Fersht, CEO of HFS Research, added that the order will likely delay new contracts:

“Clients will demand repricing or push back start dates until there is legal clarity. Some projects will be re-scoped to reduce onsite staff, while others will shift offshore from day one.”

Immigration lawyers in the U.S. reported receiving a flood of inquiries as companies scrambled to understand the order. Trump accused the IT industry of exploiting the H-1B system, justifying the $100,000 visa fee as a corrective measure.

Vic Goel, managing partner at U.S. law firm Goel & Anderson, explained:

“Employers will now reserve H-1B sponsorship for only the most critical roles. This means fewer opportunities for skilled foreign nationals, reshaping employer demand.”

Initially, confusion reigned until the White House clarified that the order applies only to new applicants, not to existing visa holders or those renewing their permits. In the days leading up to the deadline, companies like TCS, Microsoft, Amazon, and JPMorgan advised employees on H-1B visas to either stay in the U.S. or return before the cutoff date. Internal company messages seen by Reuters revealed many workers canceled travel plans at the last minute.

Several immigration lawyers expect lawsuits challenging Trump’s proclamation to surface soon. Sophie Alcorn, CEO of Alcorn Immigration Law, said:

“We anticipate several legal challenges this week, as the steep fee could be deemed excessive and discriminatory.”

The H-1B visa setback comes at a difficult time for Indian IT exporters. The sector is already facing weak growth in the U.S. due to deferred tech spending, inflationary pressures, and tariff uncertainty. Further complicating matters is a proposed 25% tax on outsourcing payments, which could erode profitability.

Industry experts warn that reduced onsite presence could hurt deal conversions and slow down scaling of new technology projects. Clients may also negotiate harder for discounts as Indian firms lose the staffing flexibility that H-1B visas once provided.

While the visa fee poses challenges, analysts believe it will accelerate the rise of Global Capability Centres (GCCs). These centers, operated by U.S. multinationals in India, Mexico, and Latin America, have evolved from back-office units to innovation hubs driving research, product design, and analytics.

Steven Hall, President and Chief AI Officer at ISG, said:

“Time zone proximity will fuel GCC growth in Canada, Mexico, and Latin America, while India will continue to dominate as enterprises shift strategic roles offshore.”

India already hosts more than half of the world’s GCCs. According to a Nasscom-Zinnov report, the country is projected to host over 2,200 such centers by 2030, representing a $100 billion market and creating up to 2.8 million jobs.

Ray Wang, Chairman of Silicon Valley-based Constellation Research, summed it up:

“Trump’s move will mean more GCCs in India, more U.S. local hiring, more automation and AI, and ultimately less reliance on H-1B visas.”

The Trump administration’s visa fee decision is not just a regulatory tweak; it is a paradigm shift for India’s IT sector. Companies will need to balance the challenges of reduced onsite flexibility with opportunities in automation, artificial intelligence, and the growing GCC ecosystem.

In the short term, disruption and legal battles seem inevitable. In the long term, however, the industry may adapt by reinventing its operating model, strengthening offshore hubs, and diversifying its global talent base.