PTBP Web Desk

Failure to pay mobile tax online or register mobile devices can result in them being blocked from local networks, making PTA compliance checks essential.

The PTA has made it relatively easy to check your mobile phone’s tax and registration status through official online channels. These methods ensure that consumers, especially those purchasing imported or second-hand phones, can avoid penalties and service disruptions.

1. Checking Status via the DIRBS Portal

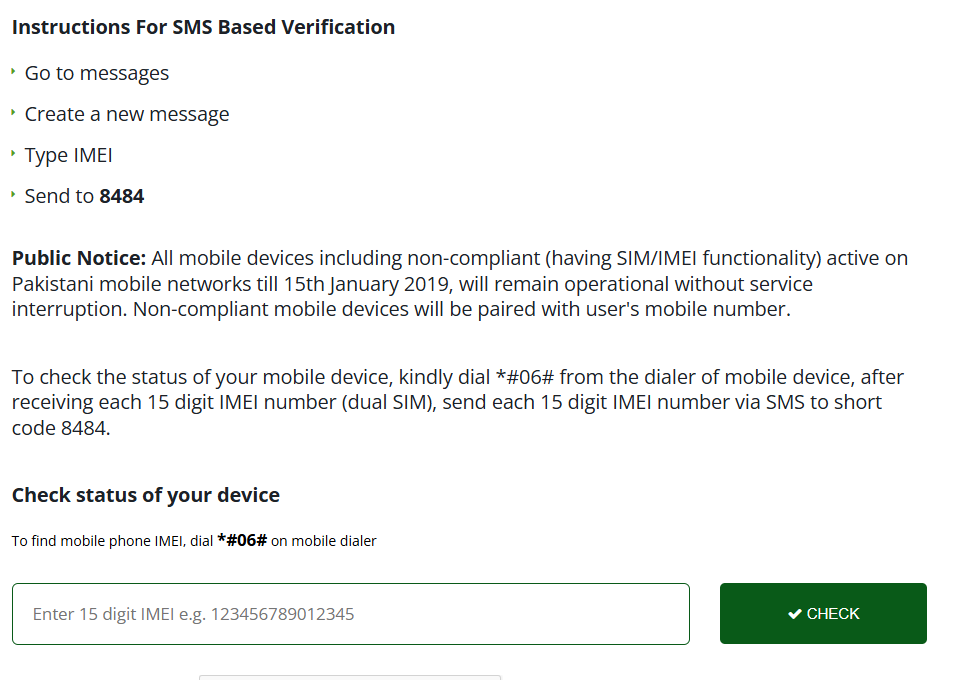

The most reliable method to check PTA registration is through the DIRBS (Device Identification Registration and Blocking System) portal. Users need to visit the official DIRBS website at dirbs.pta.gov.pk and enter their device’s 15-digit IMEI number.

IMEI numbers can be easily found by dialing *#06# on your mobile device. Once entered into the DIRBS portal, the system displays whether your device is:

- Compliant – The device is tax-paid and registered with PTA.

- Non-Compliant – Tax or registration is pending; the device may be blocked if not regularized.

- Blocked – The device has been blocked due to non-compliance or misuse.

DIRBS provides detailed information on compliance and also allows users to initiate the tax payment process if required.

2. Checking Status via SMS

For those who prefer not to use the web portal, PTA offers a convenient SMS service. Users can send their IMEI number along with their CNIC (or passport for foreign nationals) to 8484. PTA then replies with the device’s registration status and tax compliance.

This SMS-based method is especially helpful for people who do not have immediate internet access but need to verify their mobile compliance quickly.

PTA and DIRBS also provide a mobile application called DVS (Device Verification System). This app can be downloaded from official sources for Android and iOS devices. The DVS app allows users to:

- Scan or manually enter the IMEI number

- Check tax and registration compliance

- Receive alerts if the device is at risk of being blocked

The mobile app provides real-time updates and is an easy way for users to manage multiple devices or family devices.

Before paying the PTA tax, users may want to estimate the amount they need to pay. Online PTA tax calculators allow users to enter details such as device brand, model, and declared price.

The tax calculation generally depends on:

- Device value – Higher-end phones attract higher duties.

- Identification method – CNIC vs passport may affect rates.

- Applicable customs, sales tax, and regulatory duty slabs

It is important to use official calculators to avoid overpayment or errors when regularizing imported phones.

- False Social Media Claims: Recently, misinformation has circulated online suggesting PTA has waived mobile phone taxes. These claims are inaccurate. Most devices still require registration and tax payment.

- Non-Registered Devices: Phones that are not registered or have unpaid taxes risk being blocked from local networks, which can interrupt connectivity and services.

- Temporary Registration for Travelers: If you are bringing a phone from abroad temporarily, PTA allows “temporary registration” for travel-based imports. However, after the grace period, registration and tax payment are still mandatory.

Ensuring your device is registered and taxes are paid has several benefits:

- Avoid Network Blocking: Non-compliant phones are barred from operating on Pakistan’s mobile networks.

- Legal Protection: Registered phones are covered under PTA regulations, protecting consumers from illegal activity or disputes.

- Ease of Resale: Tax-paid and registered devices can be legally sold within the country without risk of confiscation.

- Contribution to National Revenue: Paying PTA tax helps formalize mobile imports, reducing smuggling and boosting national revenue.