PTBP Web Desk

Finance Minister Muhammad Aurangzeb has said that Pakistan’s economy is demonstrating signs of sustained recovery, supported by improved macroeconomic indicators, continued structural reforms, and growing international confidence. His remarks came during an interview with CGTN America on the sidelines of the IMF–World Bank Annual Meetings in Washington, DC, where he detailed Pakistan’s progress on fiscal discipline, inflation control, and international credit rating upgrades.

Aurangzeb said the country had consolidated both fiscal and external gains, leading to a more stable macroeconomic environment. He noted that Pakistan’s currency has remained stable, foreign exchange reserves now cover two and a half months of imports, and inflation has fallen to single digits — a significant improvement compared to last year.

“The policy rate has been halved compared to last year, which is helping encourage private sector activity,” the finance minister added. He emphasized that Pakistan’s economy is gradually shifting from short-term stabilization to sustainable growth, a transition supported by both domestic and international partners.

According to Aurangzeb, all three major global credit rating agencies — Fitch, Standard & Poor’s (S&P), and Moody’s — have upgraded Pakistan’s ratings this year. “It’s the first alignment among them in nearly three years,” he said, underscoring renewed investor confidence and trust in Pakistan’s reform agenda.

These upgrades signal a significant turnaround for Pakistan, which faced multiple downgrades in the past due to economic instability and high external debt. Improved ratings are expected to strengthen investor sentiment and open up new opportunities for foreign direct investment (FDI) and commercial borrowing.

Aurangzeb also confirmed that the International Monetary Fund (IMF) recently concluded its second review under the Extended Fund Facility (EFF) program. The successful review led to a staff-level agreement, demonstrating the IMF’s “trust and confidence” in Pakistan’s reform commitments.

The IMF program has been instrumental in helping Pakistan maintain fiscal discipline, reduce the current account deficit, and stabilize foreign reserves. The government’s ongoing cooperation with the IMF, combined with reforms in taxation, energy, and state-owned enterprises (SOEs), continues to reinforce macroeconomic stability.

For more details on the IMF’s engagement with Pakistan, readers can visit the IMF Pakistan page.

Addressing concerns about external debt, the finance minister said Pakistan is well-positioned to meet its future Eurobond obligations, with the next major repayment of $1.3 billion due in April 2026.

He also announced that Pakistan has successfully returned to commercial borrowing markets, especially tapping into the Middle Eastern financial market after a gap of over two years. “We are now looking forward to printing the inaugural Panda bond before the year is out,” Aurangzeb said. The Panda bond, which will be issued in the Chinese market, represents an important diversification step in Pakistan’s financing strategy.

Discussing the privatisation process, Aurangzeb acknowledged that it had been a weak area in past years but noted renewed progress. “We successfully concluded the sale of a small bank to a UAE conglomerate this fiscal year,” he said, adding that the privatisation of Pakistan International Airlines (PIA) is expected before year-end.

This marks a significant milestone in the government’s broader plan to reduce fiscal burden and enhance efficiency in state-owned enterprises.

For updates on Pakistan’s privatisation program, visit the Privatisation Commission of Pakistan.

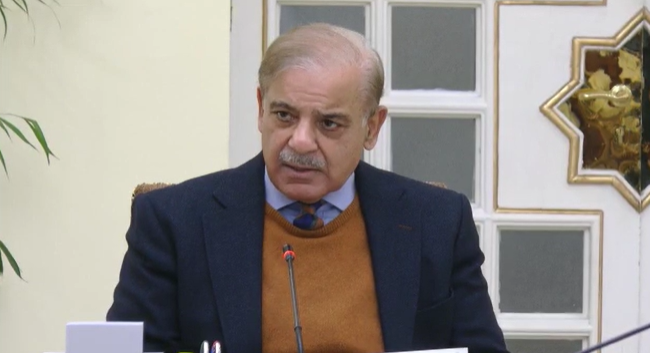

Aurangzeb also highlighted Prime Minister Shehbaz Sharif’s recent visit to Beijing, which marked the formal launch of CPEC Phase 2.0 — a new era of China-Pakistan Economic Corridor cooperation.

He shared that 24 joint venture (JV) agreements were signed during the visit, shifting from memoranda of understanding (MoUs) to actionable projects. “The focus of CPEC 2.0 is to elevate the current $19 billion trade volume to the next level,” he said.

New investment areas under CPEC 2.0 include minerals and mining, agriculture, AI and IT, and pharmaceutical manufacturing. Aurangzeb highlighted potential collaborations in vaccine production as a priority, noting that Chinese enterprises could play a key role in establishing production facilities in Pakistan.

Discussing the government’s digital transformation agenda, Aurangzeb said Pakistan aims to fully digitise all government payments by June next year. The integration of artificial intelligence (AI) and data analytics is already improving tax collection efficiency and transparency.

He credited technology for helping raise the tax-to-GDP ratio from 8.8% to 10.2%, noting that improved analytics have made tax administration significantly more efficient. These efforts align with Pakistan’s vision for a modern, transparent, and tech-driven economy.

On trade relations, Aurangzeb revealed that Pakistan has recently concluded discussions with US officials regarding tariff adjustments. These adjustments, he said, will create “real upside” for Pakistan’s textile exporters, particularly in home textiles.

He noted that a joint statement and framework agreement are in the works, which will further strengthen trade and investment cooperation between Pakistan and the United States.

Despite the positive momentum, Aurangzeb acknowledged ongoing challenges, particularly the impact of recent flooding. The devastation could lower GDP growth from the government’s earlier target of over 4% to around 3.5% for the current fiscal year.

“Climate change is an existential issue for Pakistan — we are living it day in and day out,” he said, calling for global collaboration to build climate resilience and protect vulnerable communities.