PTBP Web Desk

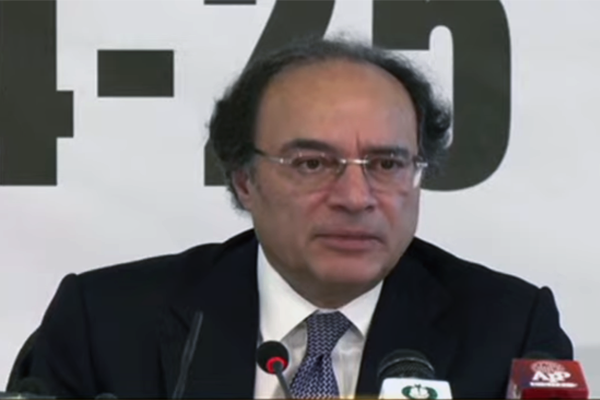

Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb chaired three consecutive high-level meetings on Friday. These sessions focused on reviewing progress in three key areas: skill development, agricultural financing for small farmers, and national energy efficiency. The initiatives, set to launch in the coming weeks, are part of Prime Minister Shehbaz Sharif’s vision for inclusive and sustainable growth.

The government has placed these projects at the center of its strategy to ensure long-term economic stability while generating measurable social impact. Aligned with the United Nations Sustainable Development Goals (SDGs), the programmes are being developed in close coordination with ministries, regulators, financial institutions, and technical partners.

The first meeting reviewed the Pakistan Skills Impact Bond, which is being recognized as the country’s first outcomes-based financing tool. Developed under the Social Impact Financing Framework, this bond aims to attract both domestic and international investors, including philanthropic and private capital.

The initiative is designed to fund projects that deliver tangible social benefits, with all financing linked to six priority pillars outlined in the Framework. These pillars are directly aligned with the SDGs, ensuring that Pakistan’s financing approach contributes to global development targets.

Minister Aurangzeb stressed that the Pakistan Skills Impact Bond should serve as a “trailblazer” for innovative financing. He emphasized that this model could demonstrate Pakistan’s capacity to attract international funding partners and outcomes-based investors. By doing so, the country hopes to diversify its investor base and set a precedent for future financing mechanisms.

According to financial analysts, the Skills Impact Bond has the potential to bring significant investment into vocational training and workforce development, strengthening Pakistan’s competitiveness in the global market.

The second meeting highlighted progress on the National Subsistence Farmers Support Scheme (NSFSS), a flagship programme approved by the Economic Coordination Committee (ECC) under the Access to Finance framework. This scheme, inspired by the Prime Minister and led by the Finance Ministry, will provide digitally enabled, collateral-free loans to smallholder farmers cultivating up to 12.5 acres of land.

A major innovation of this scheme lies in its use of agronomy-based satellite data. Through the Land Information and Management System (LIMS), banks will integrate agricultural data into their credit scoring models. This will allow them to assess farmers’ productivity and issue loans for inputs like seeds and fertilizers at affordable rates. This digital approach will also help farmers avoid the high costs of informal lending from middlemen.

The State Bank of Pakistan (SBP) is working with commercial banks and the Pakistan Banks’ Association (PBA) to operationalize this scheme. A centralized digital portal, developed by the Punjab Information Technology Board (PITB), will ensure farmers experience a smooth end-to-end journey, from loan applications to disbursements.

Minister Aurangzeb described the initiative as a “breakthrough moment” in Pakistan’s agricultural financing. He added that, “for the first time, space technology will be driving agricultural credit decisions on a national scale.”

With the 7th Agriculture Census showing that 97 percent of farmers in Pakistan own less than 12.5 acres, the scheme directly targets the most vulnerable segment. Experts believe this could transform rural livelihoods, enhance agricultural productivity, and boost financial inclusion.

Internal Link: Read more about Pakistan’s agriculture financing challenges (SBP official portal)

External Link: Learn about the UN Sustainable Development Goals

The third meeting focused on the Prime Minister’s Fan Replacement Programme, an energy conservation initiative led by the National Energy Efficiency and Conservation Authority (NEECA) in collaboration with the banking sector.

The programme is designed to replace millions of old, energy-inefficient fans with modern, energy-saving models. By facilitating access to financing options through banks, households will be able to purchase new fans on easy installments, ultimately lowering electricity consumption and reducing national energy demand.

Minister Aurangzeb emphasized that this project could help reduce the country’s reliance on costly power generation, while providing direct relief to households through lower electricity bills. The initiative also complements Pakistan’s commitments under the Paris Climate Agreement by promoting sustainable energy use.

Taken together, these three initiatives—the Pakistan Skills Impact Bond, the NSFSS for farmers, and the Fan Replacement Programme—demonstrate the government’s multi-sectoral approach to development. By combining financial innovation, digital agriculture, and energy efficiency, Pakistan is seeking to lay a stronger foundation for inclusive growth.

Analysts believe that if implemented effectively, these projects could serve as a model for other developing countries facing similar challenges. They not only address immediate needs but also introduce innovative mechanisms that could reshape Pakistan’s development financing landscape for years to come.