PTBP Web Desk

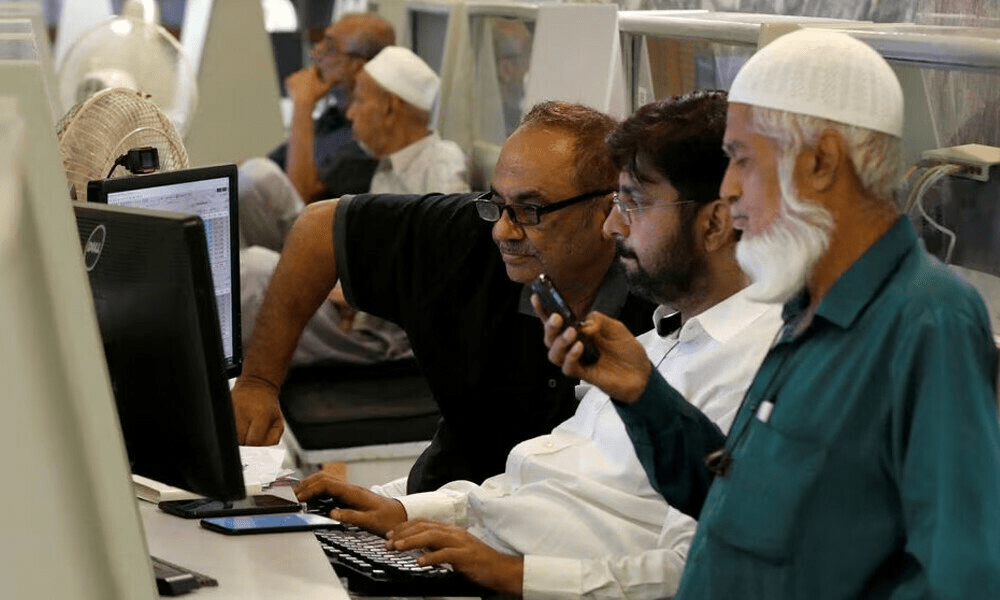

The Pakistan Stock Exchange (PSX) witnessed a volatile trading session on Monday, as the benchmark KSE-100 Index slipped nearly 250 points amid late-session selling pressure. Investors initially reacted positively, but cautious sentiment and profit-taking pushed the market lower by the close.

The trading session began on a strong note, with the KSE-100 Index climbing to an intra-day high of 163,602.15 by mid-day. However, this momentum could not be sustained, and selling pressure in the afternoon dragged the index down to 161,481.68. At the end of the session, the benchmark index settled at 161,687.18, reflecting a decline of 248.01 points, or 0.15%.

This slight retreat followed a week of strong gains for the PSX. Last week, the KSE-100 Index had risen 2,342.29 points or 1.5%, closing at 161,935.19, as investors responded positively to supportive measures in key sectors.

The upward momentum last week was largely fueled by the fertiliser sector, which benefited from reports that the Economic Coordination Committee (ECC) approved a shift from costly RLNG to Mari gas. This move is expected to ease subsidy pressures and stabilise urea prices, boosting investor confidence in the sector.

Other major sectors, including banking, cement, and energy, also contributed to the market’s gains, as strong corporate earnings and policy signals kept investor sentiment upbeat. Despite Monday’s decline, analysts noted that the PSX continues to reflect resilience amid ongoing geopolitical and economic uncertainties.

Monday’s session at the PSX also mirrored broader trends in international markets. Asia’s stock markets opened cautiously as investors awaited corporate earnings reports and key US economic data. Concerns over interest rate policies and the sustainability of recent rallies in artificial intelligence stocks influenced investor decisions.

In the US, expectations for a Federal Reserve rate cut in December dropped from over 60% last week to 40% on Monday. This shift put additional pressure on global equities, including the PSX, as markets recalibrated to the revised rate outlook. S&P 500 futures were up 0.3% in early trade, indicating a cautiously positive start for Wall Street.

In Japan, the Nikkei 225 index remained flat, although tourism and retail stocks experienced significant losses after China advised its citizens against visiting Japan amid a worsening diplomatic dispute. Shares of Isetan Mitsukoshi, a department store operator, and cosmetics manufacturer Shiseido fell nearly 10%, weighing on the broader market.

Australia’s market also faced pressure, with the ASX 200 index declining 0.7% after BHP shares dropped due to a UK court ruling holding the company liable for a dam collapse in Brazil. This legal setback contributed to the Australian bourse hitting a four-month low.

Wall Street indexes recovered from a steep selloff on Friday to post a mixed close. The S&P 500 posted a modest decline, while the Nasdaq showed slight gains, reflecting ongoing investor caution amid uncertainties about global interest rates and economic growth.

Analysts say that while the PSX displayed intraday volatility, the long-term trend remains supported by sectoral strength and policy measures. Investors are advised to monitor developments in fertiliser, banking, and energy sectors, as well as global market trends, to anticipate market movements.

“The market experienced profit-taking in the latter part of the session, but the fundamentals remain positive,” said a senior market analyst. “Investors should focus on sector-specific opportunities and remain mindful of global economic indicators that influence local market performance.”

Experts also pointed out that foreign institutional investors are closely watching developments in Asia and the US, as movements in major markets often drive trading behavior at the PSX. Any changes in US interest rates, China-Japan relations, or commodity prices could significantly influence investor sentiment in Pakistan.