PTBP Web Desk

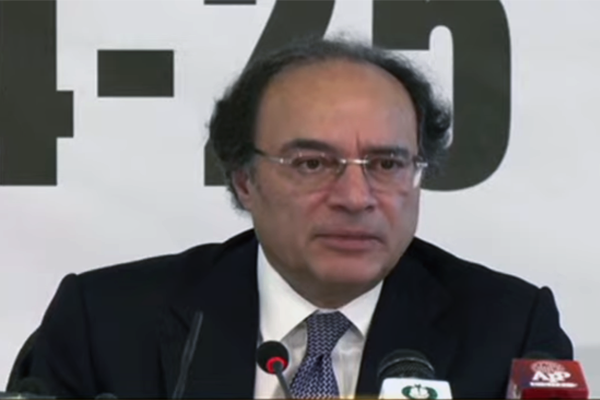

Pakistan’s economic partnership with the United States is entering a renewed phase of strength, highlighted by the landmark $7 billion financial close of the Reko Diq copper-gold project, backed by both the International Finance Corporation (IFC) and the US EXIM Bank. Finance Minister Muhammad Aurangzeb emphasized this shift while speaking at a high-level panel discussion in Riyadh during the Global Development Finance Conference – Momentum 2025.

The session, titled “Climate Adaptation & Resilience: How Do We Secure the Capital We Need?”, brought together global financial leaders, including:

- Zeina Toukan, Minister of Planning and International Cooperation of Jordan

- Qahhorzoda Faiziddin, Finance Minister of Tajikistan

- Serge Ekue, President of the West African Development Bank

The conversation centred on the rapidly escalating challenge of securing financial resources for climate adaptation, especially for developing and climate-vulnerable economies.

During the panel, Aurangzeb noted a significant strengthening in Pakistan–US economic relations, especially in high-value sectors such as minerals, mining, AI, blockchain, and digital infrastructure. He described the renewed partnership as strategic and essential for Pakistan’s long-term economic direction, especially for projects that support energy transition and industrial modernization.

The primary example of this renewed engagement is the Reko Diq project, one of the world’s largest undeveloped copper-gold reserves, located in Balochistan. Aurangzeb called the project a “transformative development” for Pakistan’s economic future, energy transition ambitions, and exports.

Aurangzeb confirmed that the financial close—valued at $7 billion—has been achieved through a syndication led by the IFC, with the US EXIM Bank participating as a major financier. This strong international backing, especially from the United States, signals rising global confidence in Pakistan’s mining sector and its long-term potential.

The finance minister highlighted several key projections:

- Reko Diq’s first commercial year (2028) could generate export revenues equal to 10% of Pakistan’s current export base.

- The mine will become a leading contributor to foreign exchange earnings.

- The project is drawing interest from US, Chinese, GCC, and other global investors, strengthening Pakistan’s standing in global supply chains for energy transition minerals.

For more context on Pakistan’s mining sector reforms, readers can explore related reports via your website’s Economy section (internal link).

When asked about navigating the geopolitical rivalry between major powers, Aurangzeb explained that Pakistan follows an “and-and” foreign policy approach—maintaining strategic cooperation with both the United States and China.

He reiterated that:

- China remains a longstanding ally, especially through the China-Pakistan Economic Corridor (CPEC).

- Pakistan has launched CPEC Phase 2.0, focusing on commercialisation, business-to-business partnerships, and productivity-driven investments.

This approach, he said, ensures Pakistan remains positioned to draw investment, technology, and market access from multiple global partners simultaneously.

Shifting to the climate challenge, Aurangzeb emphasized that climate change is imposing severe and rising economic costs on Pakistan. He cited:

- The 2022 floods, which caused $30 billion in losses

- Renewed flooding this year

- Increasing frequency of extreme weather events

These disasters, he warned, will likely shave 0.5% off Pakistan’s GDP growth this year alone, further stressing an already constrained emerging economy.

Despite this, Pakistan has created adequate fiscal and external buffers to handle immediate rescue and relief efforts through domestic resources. However, long-term rehabilitation and reconstruction require substantial international financing.

Aurangzeb pointed to progress on Pakistan’s climate preparedness, especially the development of an AI-enabled early warning system at the National Emergency Center.

The system now provides month-by-month climate forecasts, enabling:

- Faster response

- Better planning

- Improved disaster preparedness

Even so, he stressed that Pakistan’s domestic resources are inadequate compared to the scale of required adaptation, making multilateral partnerships, climate finance, and private investment essential.

For additional reading on disaster management reforms, your platform’s Climate & Environment section (internal link) offers more insights.

The finance minister also highlighted Pakistan’s new 10-year Country Partnership Framework with the World Bank Group, allocating $20 billion in assistance. Of this, one-third is dedicated to climate resilience, decarbonization, and sustainability-focused projects.

However, Aurangzeb stressed that Pakistan must now urgently prepare high-quality, bankable projects to unlock funding within this framework.

He expressed concern that global climate funds—such as:

- Green Climate Fund (GCF)

- Loss and Damage Fund

—remain slow, bureaucratic and difficult to access, especially for developing countries.

In contrast to slow-moving global climate financing systems, Pakistan has recently secured the first $200 million tranche from the IMF Climate Resilience Fund—a development Aurangzeb called a “positive and meaningful step.”

While domestic fiscal allocation will continue, Aurangzeb asserted that external financing remains indispensable for Pakistan’s climate and development agenda.