PTBP Web Desk

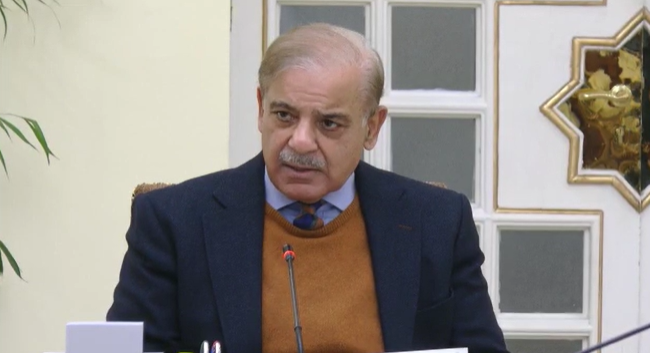

Prime Minister Shehbaz Sharif expressed his satisfaction with the declining inflation rate but underscored the critical need for comprehensive tax compliance. During a detailed briefing by the Finance Ministry and discussions on the recent engagement with the International Monetary Fund (IMF), PM Sharif issued a clear directive to intensify the crackdown on tax evaders and their facilitators.

The meeting, attended by key figures such as Finance Minister Muhammad Aurangzeb, provided insights into the nation’s economic trajectory and the outcomes of the IMF delegation’s visit from November 11 to 15. The IMF mission, led by Nathan Porter, engaged with various stakeholders including federal and provincial government officials, the State Bank of Pakistan, and representatives from the private sector.

Prime Minister Sharif emphasized the importance of stakeholder responsibility in national progress, stating, “The country’s economy can progress well when all the stakeholders meet their responsibilities. All sectors should pay taxes to play their role in the national progress.” This statement reflects a broader call for equitable tax contributions across all sectors of the economy.

The PM highlighted the positive economic developments, including a reduction in inflation from a staggering 38% to a more manageable 7%. This decline in inflation rates was coupled with a significant drop in interest rates from 22% to 15%, aimed at stimulating business activities and job creation.

Sharif also pointed out the increase in foreign reserves, attributing this to a surge in exports and record remittances, which he claimed was a direct result of the government’s robust economic strategies. However, this assertion is met with skepticism from opposition parties and some economists who argue that foreign investment might reflect other global economic factors rather than just domestic policy confidence.

Amidst these economic discussions, Sharif stressed that providing relief to the masses remains a priority. He praised the efforts of the Punjab provincial government under Chief Minister Maryam Nawaz for implementing what he described as “landmark reforms” in the agricultural sector. These reforms are intended to enhance productivity and self-sufficiency, thereby contributing to the economic stability of the region.

The directive to address tax evasion comes at a crucial time when the government is seeking to widen the tax net to stabilize finances further. PM Sharif’s call for action against tax defaulters is not just about revenue collection but also about ensuring fairness in the tax system. This move could potentially lead to:

By plugging revenue leaks, the government aims to fund public projects and reduce fiscal deficits.

Ensuring that all sectors contribute their fair share towards national development.

This might involve audits, legal repercussions for evasion, and possibly amending laws to make tax evasion more difficult.

While the government’s focus on tax compliance is clear, implementing these policies effectively involves overcoming numerous challenges, including:

Businesses might resist increased taxation, fearing it could hamper their growth.

Legal and Bureaucratic Hurdles: The enforcement of tax laws requires an efficient legal framework and administrative capability.

Critics argue that the focus on tax revenue might overlook the need for tax reforms that could encourage compliance through incentives rather than just punitive measures.