PTBP Web Desk

The Federal Tax Ombudsman (FTO) is set to submit a detailed report to the President of Pakistan regarding tax irregularities involving unrecognized educational institutions. These institutions, deemed illegal by the Higher Education Commission (HEC), are accused of widespread tax evasion and financial misconduct.

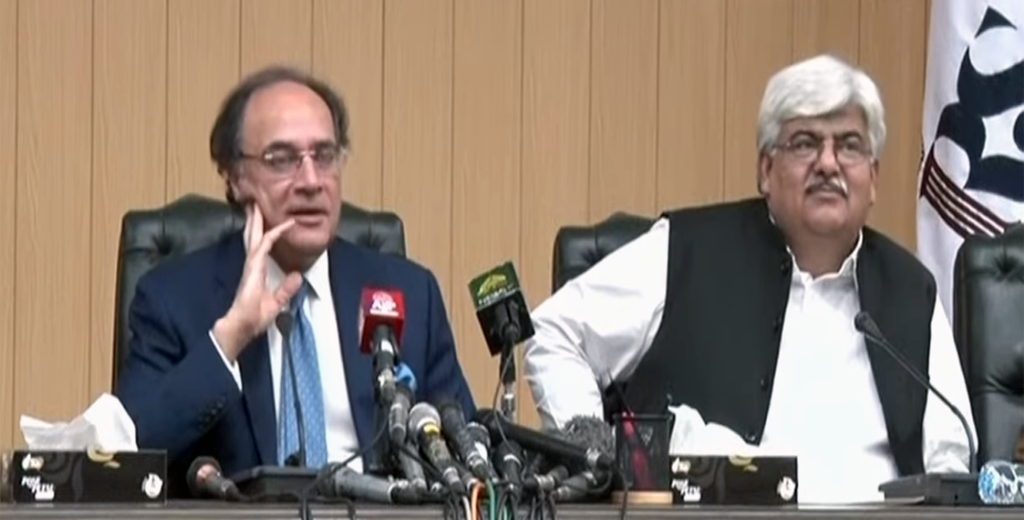

This investigation stems from a reference forwarded by the President under Section 31 of the Federal Tax Ombudsman Ordinance, 2000, based on the initiative of a taxpayer citizen, Waheed Shahzad Butt, Advocate. The FTO initiated a probe against the Federal Board of Revenue (FBR) but has yet to present its findings to the President.

The FTO’s notice, issued earlier, highlighted the gravity of the situation. It stated, “The reference has been referred by the President of Pakistan, and the FTO has ordered an investigation. You are required to submit para-wise comments addressing the issues raised in the reference.”

The investigation focuses on institutions flagged by the HEC as “Fake, Illegal, Unlawful, and Unrecognized.” These entities, while claiming to serve the noble profession of education, allegedly exploit public funds without contributing to the national exchequer.

Advocate Waheed Shahzad Butt, who brought the issue to light, emphasized the urgency of addressing these fraudulent practices. He stated, “It is essential to initiate lawful proceedings against these fake educational institutions that rob the public in the name of education while evading taxes. Their activities undermine the integrity of the educational sector.”

Despite the HEC’s regulatory framework, the tax affairs of private institutions remain inadequately monitored by the FBR. Waheed Butt urged the FBR to take immediate action under various provisions of the Income Tax Ordinance, 2001, and the Sales Tax Act, 1990, against these fraudulent entities.

The HEC has listed dozens of institutions as unrecognized, further exposing the fraudulent practices in the education sector. These entities not only deceive students but also evade taxes, causing significant revenue losses to the government.

The regulatory body maintains a structured mechanism to ensure quality education but lacks jurisdiction over the tax compliance of these institutions. This gap allows such entities to exploit the system unchecked.

The FBR is expected to take stringent measures, including:

- Investigating non-compliance under Sections 161, 205, 182, 114, 176, 177, and 214C of the Income Tax Ordinance, 2001.

- Initiating actions under Sections 11, 25, and 72B of the Sales Tax Act, 1990.

These measures aim to recover evaded taxes and hold institutions accountable for their fraudulent practices.