PTBP Web Desk

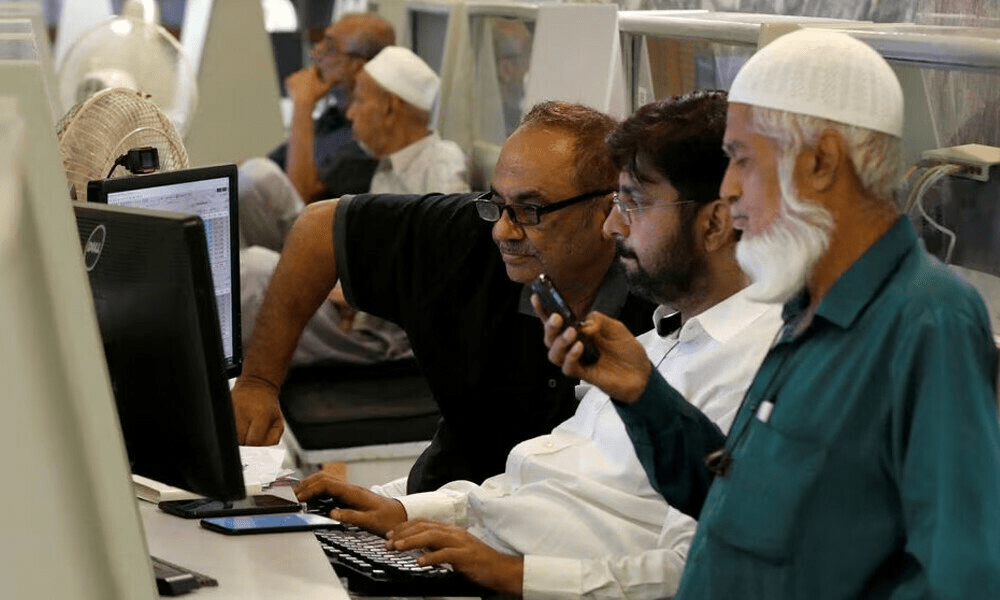

Rupee recorded a slight improvement against the US dollar in the inter-bank market on Tuesday, appreciating by 0.09% during the early trading hours. By 10:30 AM, the rupee was trading at 277.72, marking a gain of Re0.25 compared to the previous day’s closing value. On Monday, the rupee had settled at 277.97, according to data from the State Bank of Pakistan (SBP).

This modest appreciation of the rupee comes amidst ongoing economic challenges in the country, as Pakistan continues its efforts to stabilize its currency and control inflation. The recent gain, though small, reflects a degree of resilience in the local currency against the backdrop of fluctuating international markets.

Global Factors Influencing the US Dollar

Internationally, the US dollar remained robust on Tuesday, supported by a series of global developments. Political turmoil in France placed pressure on the euro, while economic concerns in China weakened the yuan to a one-year low. The US dollar’s strength reflects its status as a safe-haven currency amidst these uncertainties.

Market participants are closely monitoring upcoming US employment data, set to be released on Friday. These figures are expected to provide critical insights into the Federal Reserve’s monetary policy decisions. Currently, markets are divided on whether the Federal Reserve will opt to cut interest rates later this month, with odds evenly split. Additionally, job openings data scheduled for release on Tuesday will offer further clues about the health of the US labor market.

While December typically sees seasonal weakness in the US dollar due to companies purchasing foreign currencies for year-end transactions, this year’s trends have been different. Traders are cautiously observing the incoming administration of President-elect Donald Trump, which has contributed to sustained demand for the US dollar.

Impact of Oil Prices on Currency Parity

Oil prices, a significant indicator of currency performance for economies reliant on energy imports or exports, remained relatively stable on Tuesday. Brent crude futures edged up by 14 cents, or 0.19%, to $71.97 per barrel as of 4:04 AM GMT. This minor increase followed a negligible drop of 1 cent in the previous session. Similarly, US West Texas Intermediate (WTI) crude prices rose by 8 cents, or 0.12%, to $68.18 per barrel, building on a 10-cent gain recorded on Monday.

The oil market’s narrow trading range reflects traders’ anticipation of the upcoming OPEC+ meeting later this week. The meeting is expected to set the tone for future oil production and pricing strategies, potentially impacting currency markets worldwide. Stable or rising oil prices could provide some relief for the rupee by curbing energy import costs, a significant contributor to Pakistan’s trade deficit.

Local Implications for Pakistan’s Economy

Pakistan’s currency performance is closely tied to its macroeconomic stability. While the marginal appreciation against the US dollar is a positive sign, it remains to be seen whether this trend can be sustained in the coming weeks. The country faces significant challenges, including high external debt, inflationary pressures, and a persistent trade deficit.

Efforts by the SBP and the government to manage the exchange rate have included measures to boost foreign exchange reserves and curb speculative trading. However, the rupee’s trajectory will largely depend on global market dynamics, particularly the strength of the US dollar, oil price trends, and geopolitical developments.

The recovery of the rupee, albeit slight, could provide some breathing room for Pakistan’s import-dependent economy. A stable currency can help control inflation, reduce import costs, and restore investor confidence. However, sustained improvement will require coordinated policy efforts to address structural economic issues.

Broader Market Trends and Insights

Beyond Pakistan, global markets are grappling with volatility driven by geopolitical uncertainties and economic policy shifts. The political unrest in France and weak economic data from China are among the key factors shaping currency markets this week. The euro’s decline against the US dollar underscores the interconnected nature of global financial systems, where developments in one region can have far-reaching impacts.

The Federal Reserve’s upcoming decisions will play a pivotal role in shaping global currency trends. If the Fed opts for a rate cut, it could weaken the US dollar, providing relief for emerging market currencies like the Pakistani rupee. Conversely, a strong US labor market could reinforce the dollar’s strength, posing challenges for countries with significant dollar-denominated debts.