PTBP Web Desk

The State Bank of Pakistan is simplifying digital payment systems for merchants, aiming for a robust national infrastructure by June 2025. Explore the latest on digital payment adoption in Pakistan.

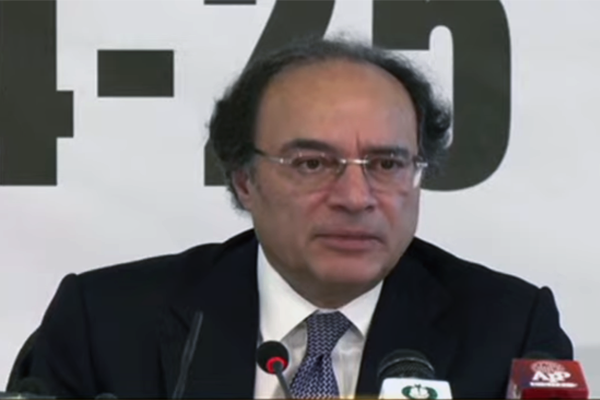

In a significant move to bolster digital financial transactions in Pakistan, the State Bank of Pakistan (SBP) is actively simplifying the process of opening merchant accounts through digital platforms. This initiative was highlighted by Dr. Inayat Hussain, the Deputy Governor of the SBP, during a crucial session of the Senate Standing Committee on Finance and Revenue held on Wednesday at the Parliament House, chaired by Senator Saleem Mandviwalla.

Dr. Hussain addressed the committee’s concerns regarding the lag in digital payment adoption, emphasizing the SBP’s commitment alongside organizations like Karandaaz to promote digital payment solutions. The initiative includes reducing the complexity of account opening forms for merchants, bringing down the document length from a daunting 16 pages to a more manageable 2-3 pages. This simplification is part of a broader strategy to incentivize consumers to use digital payment platforms, particularly those employing QR code systems for transactions.

The committee, under the stewardship of Senator Mandviwalla, has set an ambitious deadline for the establishment of a comprehensive digital payment system by June 30, 2025. This push towards digitalization aims not only to streamline transactions but also to enhance economic sovereignty by promoting local currency-based payment systems over international platforms like Visa and MasterCard.

A representative from SBP discussed key initiatives like “Raast,” an instant payment system launched in 2021, which facilitates real-time interbank transactions, and “PayPak,” Pakistan’s domestic payment card scheme. These systems are pivotal in reducing reliance on foreign payment infrastructures. Dr. Hussain informed the committee that there are currently 49 million debit cards in circulation in Pakistan, with 11.4 million of these being PayPak cards, showcasing a significant move towards domestic payment solutions.

The discussion also spotlighted Pakistan’s slower pace in adopting digital payment technologies compared to global standards. The lack of a national digital payment infrastructure was a point of concern, with Senator Mandviwalla stating, “The digital payment system is working successfully worldwide, and we must make progress in this area as well.”

In parallel, the committee addressed legislative matters, unanimously approving amendments to the State-Owned Enterprises (Governance and Operation) Bill, 2024, introduced by Senator Anusha Rehman Ahmed Khan. This amendment seeks to clarify the governance and operational guidelines of state-owned enterprises, particularly in light of privatization scenarios where government shareholding might fall below 51%. This legislative update aims to adapt laws to modern economic contexts, ensuring clarity and efficiency in the management of public sector companies.

Additionally, the committee reviewed employment practices at the Zarai Taraqiati Bank Limited (ZTBL), focusing on the recruitment processes over the last decade. Concerns were raised about the misuse of domicile certificates to bypass the Balochistan quota system. Senators Abdul Shakoor and Manzoor Ahmed Kakar emphasized the need for a thorough investigation by the Federal Investigation Agency (FIA) to verify the authenticity of the domiciles of 169 employees from Balochistan within 30 days.

This session, attended by a spectrum of senators and senior officials from the Ministry of Finance and SBP, reflects a concerted effort towards enhancing transparency, efficiency, and digital adoption in Pakistan’s financial sector. The push for simplified digital payment solutions, coupled with legislative updates, marks a pivotal step in shaping a more robust and self-reliant financial ecosystem in Pakistan.