PTBP Web Desk

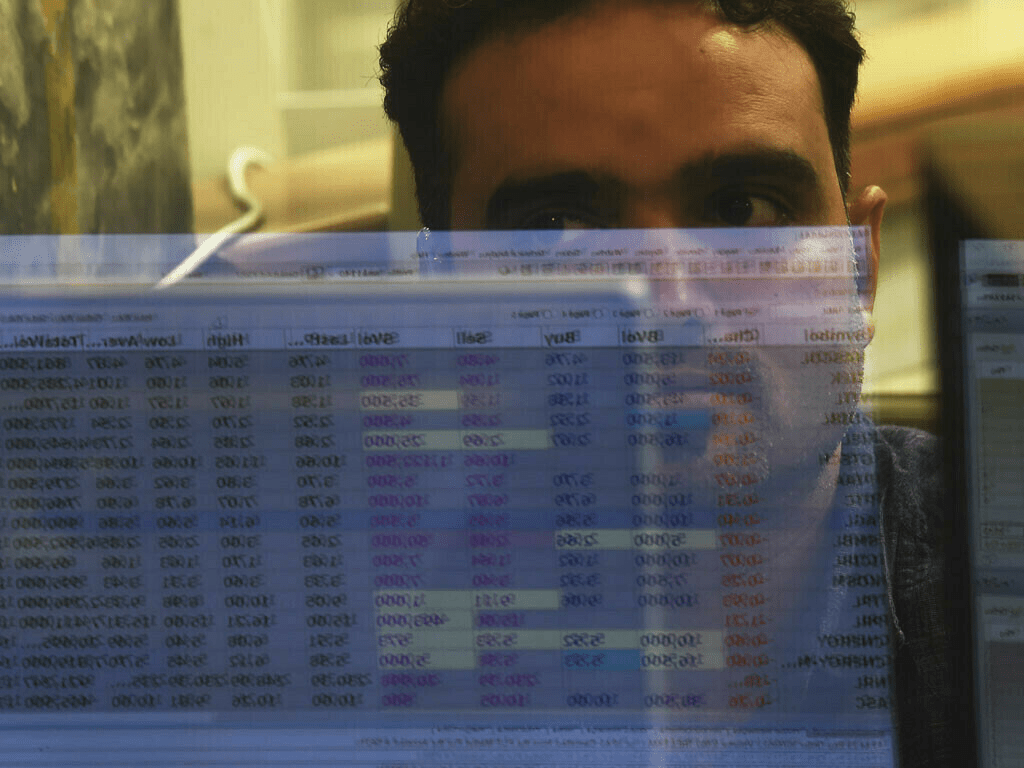

The Pakistan Stock Exchange (PSX) experienced another day of remarkable gains, with the benchmark KSE-100 Index surpassing the 107,000 mark during intra-day trading on Thursday. This bullish trend underscores the strong investor confidence prevailing in the market.

As of 2:15 PM, the KSE-100 Index stood at 107,239.17, reflecting an impressive increase of 2,134.84 points or 2.03%. This surge follows consistent buying activity across several key sectors, driving the index to new highs.

The sectors witnessing significant activity included:

- Oil and Gas Exploration Companies

- Oil Marketing Companies (OMCs)

- Refineries

- Power Generation

- Fertilizer Companies

- Commercial Banks

Major stocks such as NRL, HUBCO, PSO, SNGPL, NBP, MEBL, and MCB traded firmly in the green, contributing heavily to the index’s upward momentum.

Market experts attribute this rally to persistent buying by local institutional investors and high trading volumes, which signal robust confidence among market participants. This optimism is largely fueled by expectations of declining interest rates in the upcoming Monetary Policy Committee (MPC) meeting, scheduled for December 16, 2024.

Anticipations of a rate cut have created a ripple effect, spurring interest in index-heavy stocks. Analysts believe that if the MPC meeting delivers a significant policy rate reduction, it could further bolster market performance and attract additional investments.

The bullish trend at PSX has been ongoing, with the market hitting new records on Wednesday. The KSE-100 Index surged by 545.26 points, closing at its highest-ever level of 105,104.34. This momentum was driven by strong investor sentiment and expectations of monetary easing, which are anticipated to enhance corporate profitability and stimulate economic growth.

While the PSX thrives on local confidence, the broader Asian market landscape paints a contrasting picture. Foreign investors have continued to sell heavily in November, withdrawing a net $15.88 billion from equity markets in major regional economies such as Taiwan, South Korea, India, Thailand, Indonesia, Vietnam, and the Philippines. This follows a net withdrawal of $15.38 billion in October, marking the largest monthly outflow since June 2022, according to data from LSEG.

This sell-off is attributed to concerns over potential tariff hikes by the United States under the incoming Donald Trump administration. Last month, Trump pledged significant tariffs on the US’s three largest trading partners, including China, a move that could disrupt regional exports and global supply chains. These developments have led to increased uncertainty in Asian markets, in stark contrast to the optimism observed in Pakistan’s stock market.

The sustained upward trend at the PSX signals strong investor confidence in the country’s economic direction. If the Monetary Policy Committee meets market expectations with a notable interest rate cut, this could lead to further gains and heightened activity in key sectors. Additionally, improving macroeconomic indicators and supportive fiscal policies will be essential to maintaining this momentum.

For real-time updates on Pakistan’s stock market performance, visit the PSX official website. Insights into global market trends and their potential implications can be explored through the LSEG official website.