PTBP Web Desk

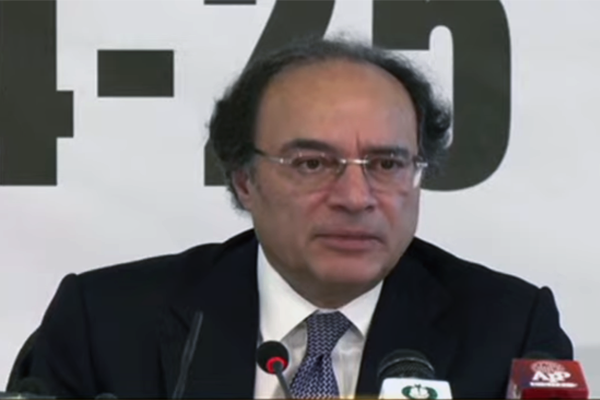

Finance Minister Muhammad Aurangzeb announced on Monday that Pakistan’s tax policy office will no longer be part of the Federal Board of Revenue (FBR). Instead, it will operate directly under the Ministry of Finance, marking a structural change that redefines how the country’s budget will be formulated in the future.

The minister made this announcement while addressing a workshop titled “Unlocking Capital Market Potential for Banks,” jointly organized by the Securities and Exchange Commission of Pakistan (SECP) and the Pakistan Banks Association (PBA).

For decades, the FBR has been central to Pakistan’s budget-making process, preparing tax policies and revenue collection targets. However, with this transition, the FBR will no longer play that pivotal role.

“Tax policy office is now moved into the Finance Division. FBR has nothing to do with the policy. The next year’s budget to be presented in 2026 (for FY27) will be led by the finance and tax policy office and not by FBR,” said Finance Minister Aurangzeb.

This decision is seen as an effort to separate tax policy from tax administration, thereby reducing conflicts of interest and improving policy credibility. The shift is also aligned with global best practices, where finance ministries typically set policy frameworks while revenue authorities focus on enforcement and collection.

Aurangzeb revealed that the government is also finalizing a comprehensive industrial policy to provide an enabling environment for industries and accelerate industrialization.

He highlighted that Haroon Akhtar, Special Assistant to the Prime Minister, is spearheading efforts to finalize the policy and present it before the cabinet for approval.

“This is an important element of how we are going to move from stability to sustainable growth, because these underline pillars are going to be quite critical,” Aurangzeb explained.

The government has already rolled out several sectoral policies in recent months, including those for tariffs, electric vehicles (EVs), digital transformation, and efforts to transition toward a cashless economy.

Discussing tariff reforms, the finance minister said the government is committed to reducing customs duties, additional customs duties, and regulatory duties over the next four to five years.

“This is essential to improve export competitiveness and also to take away the protection that we have provided certain industries for the longest time,” he said.

The move aims to make Pakistani industries more competitive in global markets by lowering costs and reducing dependency on protectionist measures.

Aurangzeb stressed that while institutions like the World Bank have provided technical input, the tariff reform agenda is entirely homegrown.

“I just want to be very clear the IMF has nothing to do with it. Tariff reforms are very much a home-grown agenda of the government and this administration to make our industry more competitive as we go forward.”

The minister acknowledged resistance within the FBR and the finance ministry itself, as officials worry that lowering tariffs could negatively impact revenue collection.

“They say our revenue (collection) will fade away if we keep reducing duties,” he admitted.

However, Aurangzeb emphasized the need to move away from short-term thinking focused solely on revenue collection. Instead, he urged policymakers to take a long-term perspective.

“We have to see what is the right thing to do for the country over the next four to five years if we are going to grow and move towards supporting competitiveness.”

Aurangzeb also pointed out the absence of the corporate sector at the workshop, despite being a key stakeholder in capital market development. He stressed that corporations, through equity and debt financing, are instrumental in mobilizing funds for economic growth.

The minister proposed the creation of a Capital Market Development Council to strengthen domestic financial markets, especially the Pakistan Stock Exchange (PSX).

This council, he suggested, should include stakeholders such as the SECP, the State Bank of Pakistan (SBP), the PBA, corporations, insurance institutions, and provincial representatives.

“A lot of execution power now lies with provinces,” he noted, underscoring the importance of provincial involvement in capital market reforms.

The transfer of the tax policy office marks a significant step in the government’s broader reform agenda, which seeks to:

- Separate policy and administration for better governance.

- Reduce reliance on protectionist tariffs.

- Strengthen domestic capital markets.

- Introduce industry-specific reforms for long-term growth.

- Promote a digital, cashless economy to enhance transparency.

Experts believe these reforms, if implemented effectively, could help Pakistan break free from the cycle of short-term stabilization measures and move toward sustainable economic growth.

By shifting the focus from revenue-maximization to competitiveness and industrial development, the government hopes to create a business-friendly environment that attracts both domestic and foreign investment.